BlackRock quietly accumulated 3% of all Bitcoin. Here’s what that means

What percentage of Bitcoin is owned by BlackRock?

BlackRock’s entry into the Bitcoin market through the iShares Bitcoin Trust (IBIT) has marked a new era in institutional Bitcoin accumulation.

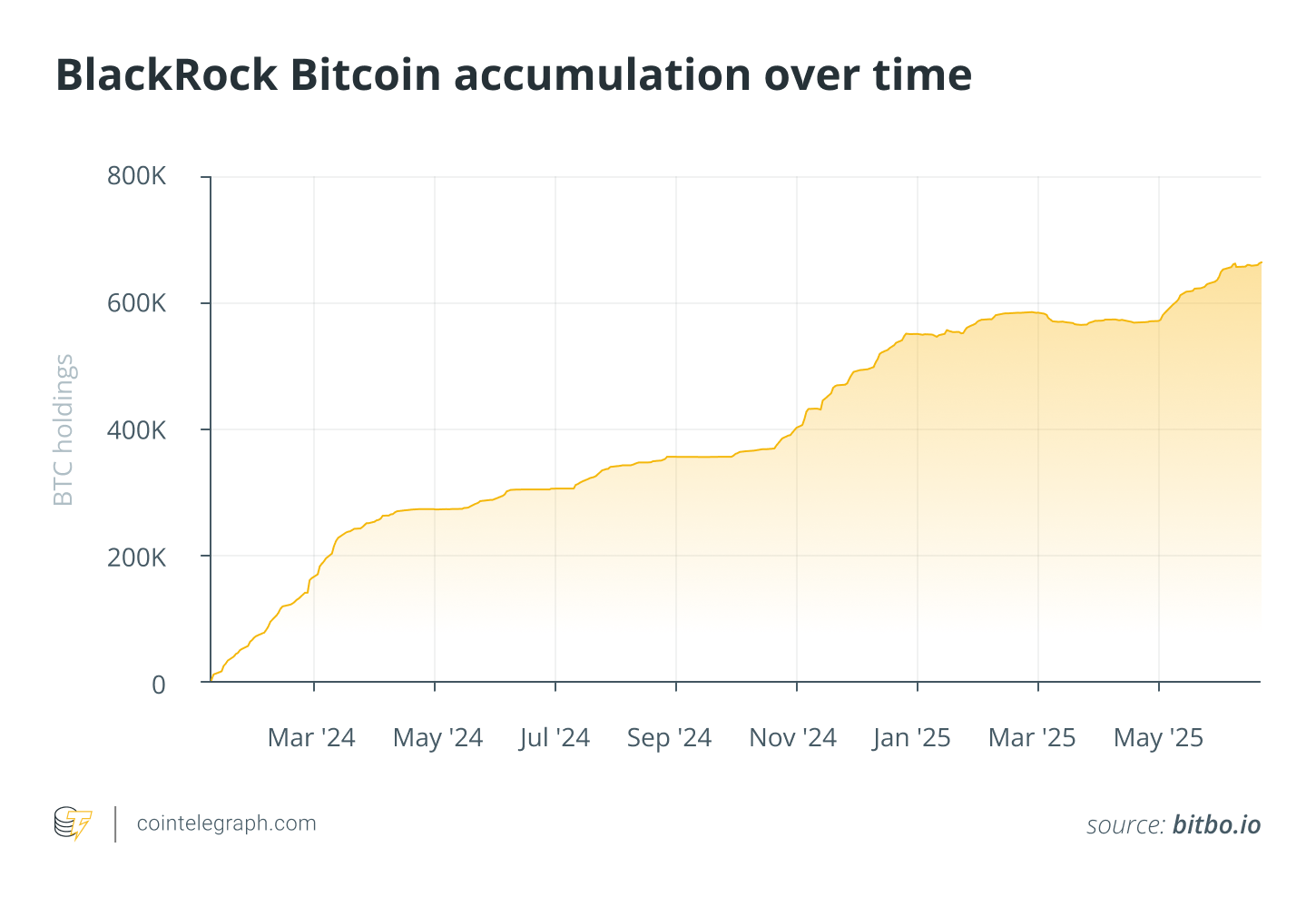

Since its launch on Jan. 11, 2024, IBIT has grown at a pace that few expected, and no other ETF has matched. As of June 10, 2025, BlackRock holds over 662,500 BTC, accounting for more than 3% of Bitcoin’s total supply. At today’s prices, that’s $72.4 billion in Bitcoin exposure, a staggering figure by any measure.

For comparison, it took SPDR Gold Shares (GLD) over 1,600 trading days to reach $70 billion in assets under management. IBIT did it in just 341 days, making it the fastest-growing ETF in history. In addition to being a milestone for BlackRock itself, this fact also shows us how deeply institutional interest in Bitcoin has matured.

BlackRock’s Bitcoin holdings now eclipse those of many centralized exchanges and even major corporate holders like Strategy. In terms of raw Bitcoin ownership, only Satoshi Nakamoto’s estimated 1.1 million BTC outnumbers IBIT, and that lead is narrowing.

If inflows continue at the current pace, IBIT may eventually become the single largest holder of Bitcoin, a major change for Bitcoin supply distribution and ownership concentration.

BlackRock Bitcoin accumulation over time

Did you know? Coinbase Custody, not BlackRock, holds the private keys for the BTC in IBIT, safely storing client assets offline and backed by commercial insurance.

Why is BlackRock betting big on Bitcoin in 2025?

Behind BlackRock’s massive allocation is a strategic shift in how it views Bitcoin: as a legitimate component of long-term, diversified portfolios.

The BlackRock Bitcoin strategy

BlackRock’s internal thesis embraces Bitcoin’s volatility as a tradeoff for its potential upside. With IBIT, they’re betting that broader adoption will stabilize the asset over time, improving price discovery, increasing liquidity and narrowing spreads.

In this view, Bitcoin is a long-term play on monetary evolution and digital asset infrastructure.

This philosophy (coming from the world’s largest asset manager) sends a strong signal to peers. It reframes the conversation around institutional adoption of Bitcoin, shifting it from “whether” to “how much” exposure is appropriate.

The investment case for institutional Bitcoin accumulation

BlackRock highlights several factors that make Bitcoin appealing in 2025:

- Scarce by design: With a hard cap of 21 million coins and a halving-based issuance model, Bitcoin scarcity mirrors gold, but with a digital backbone. Some estimates suggest a meaningful share of existing coins are lost or inaccessible, making the effective supply even tighter.

- Alternative to dollar-dominance: With growing sovereign debt and geopolitical fragmentation in mind, Bitcoin’s decentralized nature offers a hedge against fiat risk. It’s positioned as a neutral reserve asset, resistant to government overreach and monetary manipulation.

- Part of the broader digital transformation: BlackRock views Bitcoin as a macro proxy for the shift from “offline” to “online” value systems, from finance to commerce to generational wealth transfer. In their words, this trend is “supercharged” by demographic tailwinds, especially as younger investors gain influence.

Put together, these factors provide distinct risk-return characteristics that traditional asset classes can’t replicate. BlackRock’s framing (that Bitcoin offers “additive sources of diversification”) makes a compelling case for its integration into mainstream portfolios.

BlackRock crypto portfolio integration

BlackRock advocates a measured approach, 1% to 2% exposure within a traditional 60/40 stock-bond mix. This may sound small, but in a portfolio of institutional scale, it’s enough to generate impact and normalize Bitcoin exposure for conservative allocators.

They also benchmark Bitcoin’s risk profile against high-volatility equities, like the “Magnificent Seven” tech stocks, to demonstrate how it can fit within standard portfolio models.

Did you know? Unexpected by-products (“dust”) from Bitcoin transactions within IBIT have included tiny amounts of other tokens. BlackRock keeps these in a separate wallet or donates them to charity, avoiding tax complications.

BlackRock Bitcoin ETF impact

BlackRock’s decision to accumulate over 3% of Bitcoin’s total supply through its iShares Bitcoin Trust (IBIT) is a turning point for how Bitcoin is perceived, traded and regulated.

Bitcoin has always been known for its volatility, driven by fixed supply, shifting sentiment and regulatory uncertainty. Historically, the relatively thin liquidity of crypto markets made large trades highly impactful. Now, with IBIT absorbing hundreds of thousands of BTC, the question is whether institutional capital will stabilize or further complicate the market.

Supporters of the ETF model argue that institutional Bitcoin investment helps reduce volatility. With regulated players like BlackRock involved, the thinking goes, Bitcoin becomes more liquid, more transparent and more resistant to erratic moves.

BlackRock itself has stated that broader participation improves Bitcoin price discovery, deepens market liquidity and can lead to a more stable trading environment over time.

On the other hand, critics (including certain academics) warn that large-scale institutional involvement introduces traditional market risks into Bitcoin. These include leveraged trading, flash crashes triggered by algorithms and price manipulation via ETF flows.

In this view, Bitcoin’s financialization may trade one kind of volatility (retail-driven FOMO) for another (systemic, leverage-based risk). Also, as ETFs grow in influence, Bitcoin may become more correlated with other financial assets, undermining its value as an uncorrelated hedge.

Institutional Bitcoin accumulation lends mainstream legitimacy

Undoubtedly, BlackRock’s crypto strategy has turned Bitcoin from a fringe asset into a mainstream investment tool.

For years, Bitcoin was dismissed by major financial institutions. BlackRock’s deep exposure to BTC signals that the tide has turned. The launch of IBIT (and its rapid ascent to become one of the largest Bitcoin holders globally) has legitimized Bitcoin in a way no white paper or conference ever could.

ETFs like IBIT offer a familiar, regulated structure for exposure, especially for institutions wary of the technical complexity or custodial risks of direct crypto ownership. BlackRock’s involvement reduces reputational risk for others on the fence. In effect, this has normalized Bitcoin ownership by institutions, accelerating its inclusion in traditional portfolios.

Retail investors benefit too. Instead of navigating wallets, seed phrases and gas fees, they can gain exposure to Bitcoin with a click through traditional brokerages.

Did you know? Abu Dhabi’s Mubadala sovereign wealth fund owns a significant stake in IBIT, with filings showing around $409 million invested.

BlackRock owns 3% of Bitcoin: A growing paradox

Bitcoin was built as a decentralized alternative to centralized finance. However, when the world’s largest asset manager buys up over 600,000 BTC via a centralized vehicle, it creates a paradox: The decentralized asset is increasingly controlled by centralized institutions.

Most users today rely on centralized exchanges (CEXs), custodians or ETFs. These platforms are easier to use, offer security features like insurance and cold storage and provide regulatory compliance (KYC, AML), which many see as essential. In contrast, decentralized tools like DEXs and self-custody wallets have higher friction, lower liquidity and less user protection.

So even as Bitcoin remains technically decentralized, most people interact with it through centralized layers. Here, BlackRock’s Bitcoin accumulation is emblematic. While some argue this undermines Satoshi’s original vision, others view it as a necessary trade-off, a “centralization of access” that allows Bitcoin to scale to global relevance.

This is the heart of the Bitcoin centralization debate: balancing ideological purity with practical adoption.

For now, the market seems to be accepting a hybrid model, with decentralized base layers and centralized access points.

The regulatory catch-up game

BlackRock’s ability to launch IBIT was made possible by a landmark decision: the US Securities and Exchange Commission’s approval of spot Bitcoin ETFs in early 2024. That ruling broke a years-long deadlock and opened the floodgates for institutional capital. Still, the broader regulatory environment remains inconsistent and often contradictory.

One of the biggest challenges when it comes to crypto? Asset classification. The SEC continues to send mixed signals on whether various tokens, like Ether

or Solana

, are securities. This regulatory gray zone has delayed the development of products like staking ETFs or altcoin ETPs, and created confusion for investors, developers and issuers alike.

As Commissioner Caroline Crenshaw has pointed out, the SEC’s current stance creates “muddy waters” and reactive enforcement that stifles innovation. This directly impacts whether institutions feel confident investing beyond Bitcoin.

For now, Bitcoin enjoys a more straightforward regulatory path. For the broader crypto market to mature, including Ether ETFs or DeFi-linked products, a more consistent and globally aligned regulatory framework will be essential.

Institutions are ready – but they need rules they can trust.

Disclaimer:

- This article is reprinted from [cointelegraph]. All copyrights belong to the original author [Bradley Peak]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge